Should you be involved in a lending circle with relatives or close friends, which might be the same way to borrow money rapid. Which has a lending circle, participating customers pool their cash with each other and loan a set volume out to every member over a rolling foundation.

Lenders are generally hesitant to lend large quantities of revenue without promise. Secured loans minimize the risk of the borrower defaulting given that they threat dropping whatever asset they set up as collateral.

Unsecured loans normally feature better interest premiums, reduce borrowing limitations, and shorter repayment conditions than secured loans. Lenders might from time to time require a co-signer (a one who agrees to pay for a borrower's personal debt if they default) for unsecured loans In case the lender deems the borrower as dangerous.

It's also essential to contemplate no matter whether $twenty,000 is the proper quantity to borrow for your financing desires. Borrowing an excessive amount means earning increased payments and paying more on curiosity than necessary. Then again, borrowing too minor could go away you on the lookout For extra financing.

Applicants with reduced credit rating scores will possible get offers with greater curiosity costs and charges than individuals with more robust credit rating scores get.

Most applicants question a trustworthy relative or Close friend for being a co-signer or co-borrower. Nonetheless, the other human being can be reluctant as this arrangement can destruction a romantic relationship In the event the loan is now not in very good standing.

Numerous consumer loans tumble into this class of loans that have common payments that happen to be amortized uniformly in excess of their lifetime. Plan payments are made on principal and interest until eventually the loan reaches maturity (is completely compensated off). Many of the most familiar amortized loans include things like mortgages, motor vehicle loans, college student loans, and private loans.

A score of close to 670 or maybe more will improve your odds of getting authorized for a larger loan total at the bottom charges out there.

Many industrial loans or limited-time period loans are Within this class. Not like the main calculation, that is amortized with payments spread uniformly in excess of their lifetimes, these loans have one, significant lump sum due at maturity.

On the other hand, this does not impact our evaluations. Our thoughts are our possess. Here is a summary of our associates and This is how we earn cash.

Make sure to just take regular monthly payments, curiosity rates and costs into consideration. Some frequent fees involve an origination cost, disbursement price and prepayment penalty. Large fees could offset the price savings you have from a small curiosity rate.

Your limit will be exhibited to you within the Chime cellular application. You are going to acquire recognize of any changes to the Restrict. Your limit may possibly change Anytime, at Chime’s discretion. Although there aren't any overdraft service fees, there may be out-of-network or third party expenses related more info to ATM transactions. SpotMe gained’t address non-debit card transactions, which includes ACH transfers, Fork out Any person transfers, or Chime Checkbook transactions. See Conditions and terms. Tipping or not tipping has no influence on your eligibility for SpotMe.

After you confirm the quantity you may need, ensure that the possible payments will fit your spending plan, states Todd Nelson, senior vice president of strategic partnerships at LightStream.

If you'll want to borrow a large amount of cash – including $twenty,000 or maybe more – a private loan may be your best selection. Own loans permit you to borrow funds for almost any reason, and maybe borrow much more than you can using a charge card.

Romeo Miller Then & Now!

Romeo Miller Then & Now! Anthony Michael Hall Then & Now!

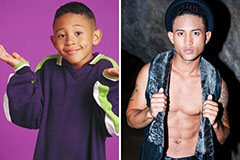

Anthony Michael Hall Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now!